Book

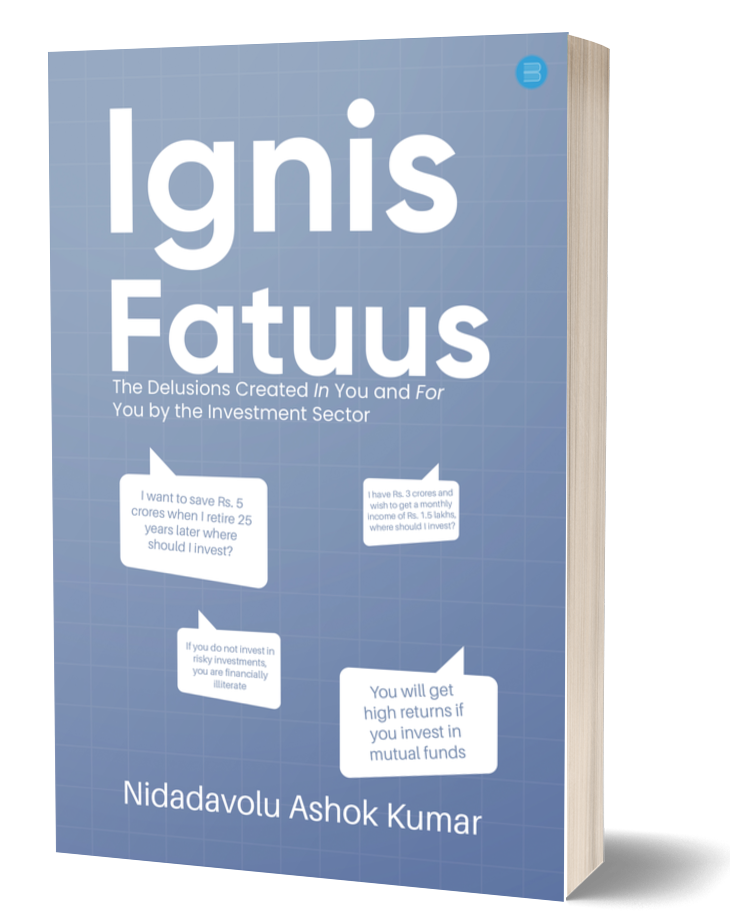

Ignis Fatuus: The Delusions Created In You and For You by the Investment Sector

Investors believe, by and large, that the fraud is perpetuated mostly by the agents who sell them the investments. The agents are only a small proportion of the persons cheating investors. The main actors are behind the scenes.

The Book offers insights on how investors are cheated by academicians, the media, the asset management company, the fund managers and other experts. These experts create a world of delusions (called ignis fatuus in Latin) to feed the investors’ desire to earn money quickly.

The Book describes the environment that has been created in the financial sector and how it facilitates fraud and deception. The 10 most-common statements that experts make which create the world of ignis fatuus (delusions) for investors are examined. Evidence is provided to show why all the statements that promise investors high returns amount to a misrepresentation or fraud.

Other Details

Total Pages

248 Pages

Publishing Date

24 January 2024

Publisher

Bluerose Publishers Pvt. Ltd.

Reading Age

Any Adult

Book is available on

Author’s Note

Lakhs of investors who accepted advice of their financial advisors or friends or the media, have lost their money through wrong investment advice. Most often, the lay investors blame the agent for the wrong advice given. Some of the investors even feel that they have been deliberately cheated by the agent.

In general, the number of cheats amongst the financial commission agents who sell to you, will broadly reflect the proportion of cheats amongst the general population. Most people amongst the general population are not cheats. Similarly, most of the agents too are therefore not cheats. But the feeling exists and is widespread.

The truth lies elsewhere.

Agents selling mutual funds or ULIPs, or shares to you are at the bottom of the ladder in the investment sector. There is a big, big world around them that has built powerful systems and mechanisms to protect their own self-interests, and the role of the agent in your being cheated is highly limited.

The big, big world of the financial sector consists of many groups of individuals and institutions. They have constructed an environment to protect their own self-interests. Investor interest is not at all in their mind or in their working system. In fact, protecting their own self-interest is very often at the cost of the interests of the investors who provide the sector with their hard-earned money.

Take, for example, Modern Portfolio Theory (MPT), propounded by academicians (two of them also got a Noble Prize). The proponents of MPT make it seem that the model is fool proof and if an investor follows the principles of MPT, he or she will gain a lot. In reality the MPT is a half-baked theory which can never be fully baked because it relies on probability.

Probability theory does not tell us in any practical manner where we should invest. But with the backing of sophisticated mathematics and statistics, which no one outside academics understands, we are told that MPT is the answer to your portfolio management. Legend and lore is written around MPT making the gullible fall for their theories.

Or take for example the organisation of mutual fund entities. The asset management company (AMC) of any fund wants to maximize its profitability. To do so, for example, one of the many things they do is to quietly transfer funds from low performing funds to high performing funds. The fund value of the high performing fund increases, as a result, and the AMC benefits. Investors of the lower performing fund lose out. And the investor does not even know that fund transfers have taken place.

Or take for example the fund manager. There is limited control over the fund manager on his or her investment decisions. Many fund managers take this god-sent opportunity to take very high risks in investments in the hope of earning more money. But money does not grow on trees. Most often such high-risk investments turn sour, and investors lose.

While all this is happening in the background away from the knowledge of the investor, up front in full public glare the media produces articles and talk shows where expert after expert tell the reader or viewer, that earning 10 % or 15 % every year on mutual fund investments for the next 15 to 20 years is a reasonable expectation to have. No one contests these claims. Dreams are built and investors lose money.

With 40 years of experience in the financial sector, mostly as a teacher and researcher, I thought that lay investors should be made aware of the inherent, built-in mechanisms of self-interests within the financial sector that are designed to act against the interests of investors. The book Ignis Fatuus takes a detailed look at how these self- interests are created and how they operate.

The built-in mechanisms within the financial sector are designed to foster fraud, deception, and mis-selling. Delusions of earning big money quickly are created. The word in Latin for delusions is Ignis Fatuus. Hence this book is titled Ignis Fatuus.

Ignis Fatuus is created all around the investor. It comes from academicians, fund organisations, fund managers, wealth managers, portfolio managers, banks, bank relationship managers, brokers, media and the so-called experts who write or talk in the media and financial advisors. Ignis Fatuus is also made possible by inadequate regulatory supervision, compromised credit rating scores and misleading audit reports.

Some of the delusions created include,

- That the only way to earn a lot of money is through mutual fund investments, or,

- If you invest your money in bank fixed deposits inflation will erode your capital, or,

- The only way in which you can earn high returns is to take investment risks.

These and many more statements that are thrown at you create the Ignis Fatuus – the world of delusions. Some of the claims made through such statements are outright fraud. Yet all statements go uncontested, unchallenged. Lay investors, having read the statement and the claim it makes of high return, published in a newspaper or on a TV channel of repute, believe the falsification and are led to take wrong investment decisions.

I have written the book Ignis Fatuus: The Delusions Created for YOU and in YOU by the Investment Sector, to educate lay investors on the financial world they are dealing with. Investors should know the powerful self-interests that are at play and therefore not believe most of the claims made. Especially the tall claims that indicate you can earn 10 % or 15 % every year for the next 20 years.

I invite you to read the book, Ignis Fatuus, to enlighten yourself on the financial sector’s underworld. Take care of your money. No one in the financial sector will do it for you. They are not concerned about your money. They will claim ownership of any success you may have, through sheer luck, in investments. They will wash their hands off if you lose. Most often, their advice leads to a loss. Sometimes your entire savings is lost.

The 360º Circle of Ignis Fatuus

The stock market is filled with individuals who know the price of everything and the value of nothing.

Philip Fisher, a legendary stock market investor and author of Common Stocks and Uncommon Profits.

Many decades ago, while I was undertaking research on the economics of biogas, I came across a Latin term – Ignis Fatuus. In its earliest use, it meant

foolish fire and it referred to a phenomenon that looked like fire dancing and moving in the air over marsh land. It was actually a phenomenon of a colony of fireflies moving around in the air. From a distance, it looked like the ‘fire’ was dancing. In the 17 th century, people called this fire, Ignis Fatuus – literally translated as foolish fire. Subsequent use of the term Ignis Fatuus came on to denote a misleading hope, created by deception or delusion. Ignis Fatuus refers to an illusion created with an intention to mislead or misrepresent.

Having spent a good four decades in the financial sector, and having seen at regular intervals frauds, deceptions, and scams in this period, I feel the term

Ignis Fatuus is an apt description for the kind of advice that comes from the financial services sector in general and the investment advisory sector in particular.

Most persons feel challenged when it comes to investment in risky instruments such as shares or mutual funds. The challenges lead the

layperson to an expert. The investment advisory sector has minimum regulatory oversight and greedy experts with a high greed to earn money fast.

The experts are (mostly) qualified but uneducated. This combination is fertile ground for actions that are deceptive, that mislead, that misrepresent, and very often fraudulent.

An Ignis Fatuus is thereby created for laypeople by the various ‘experts’ and institutions in the investment advisory sector.

Who are the ‘experts’ who create Ignis Fatuus?

There are many categories of ‘experts’ who do so. They offer different kinds of services. You may come in direct contact with some of the ‘experts’. Others operate in the background, but who, are also in the business of creating Ignis Fatuus. They are the academicians, regulators, investment ‘experts’ and advisors, distributors and agents, and even your friends and relatives.

They are the academicians, who claim a Nostradamus power to predict the future and claim to have grasped the concept of investment risk. Working with equations, and a whole lot of statistics, they claim they can predict the future with a reasonable degree of accuracy. Their cock-sure attitudes backed by incomprehensible mathematics, puts them in a league that practitioners do not understand and therefore do not question.

They are the regulators, who conveniently, as an operating norm, turn a blind eye to all that is happening around them. And who, invariably, react after the horse has bolted. Once a fraud takes place the regulator gets into overdrive to set things right. In many instances in the financial sector, there are warning signals in advance, which are largely ignored.

They are your media supported authors of articles published in print and opinions given in talk shows in the visual media. In a daily barrage of

information flow, they tell you how you are financially illiterate and why investing in high-risk investments is the only way out for poor souls like you.

Without batting an eyelid, and looking straight into your eye, they tell you can get rich quickly if you invest in mutual funds and shares by giving you unrealistic projections of the future. Very cunningly they call this a high return investment (and not high risk), when it is nothing of the sort.

They are the fund and investment managers of Unit Linked Insurance Plans (ULIPs) and mutual funds, and your personal wealth managers, and

portfolio managers, who claim they can get better returns than the market. They call it beating the market. Beating the market is the altar of their temple called financial markets. You are their sacrificial goat.

They are the brokers who illegally double up as your financial portfolio managers with promises reaching the skies and who one fine day after

making losses (and lose all the money you have entrusted them with), just close shop.

They are your financial advisors who advice you on investments and who claim that you will get at least 10 to 20 % return on your investment portfolio

every year for the next 20 years. Whether you get the promised returns or not, they make theirs, buy a farmhouse and retire.

They are your distributors and agents and bank relationship managers, who claim that you will double your investment in 5 years. Not knowing much about investments, they depend on their managers and the opinions of ‘experts’ presented in media articles and talk shows. They are the foot messengers of those in the ivory towers of investments. They put it all in a layperson-friendly language to convince you.

They are your friends and relatives who advice you (with a good intention), to invest, based on the impressions gathered from all the others mentioned

above. They usually do not have an opinion of their own, unless they have adequate hands-on investment experience. They, mostly, learn from the other

‘experts’ in the sector. While the intention is good (unlike the others mentioned above), the result is the same. You are led up the wrong path.

These financial ‘experts’ surround you on all sides to advice you on financial investments. Some directly, others indirectly. They reside within the Circle of Ignis Fatuus that surrounds you.

Low-risk and high-risk investments

If as a layperson you followed the simple method of investing in low-risk investments such as nationalised banks, post office savings, traditional life insurance, public provident fund and various other government saving schemes, there exists no reason for you to labour over concepts in finance

and investment and go to ‘experts’. The problem arises when you are interested or drawn to invest in higher risk investments, such as shares, mutual funds and company debentures.

There is a media blitzkrieg on the uselessness of low-risk investments. Very cleverly and mischievously, the ‘experts’ call this a low-return investment.

They ignore the fact that it is low risk. Low risk instruments have a very important role to play in profit optimisation in a portfolio, as we shall see later in the book. A fact you are never told.

Modern Portfolio Theory teaches us that every investment portfolio should contain a balance of low-risk and high-risk investments. Do not put all your eggs in one basket, so to say. If, for some reason, the basket falls, you lose all your eggs. In investments, one spreads risks. You should create different

baskets for different needs, and with different degrees of risk categories. This is done to ensure that all your investments do not fail at the same time. An

essential part of investment management is – using low risk investments to optimise your investment portfolio.

In an economy like that of India, where the lower limit of the time deposit interest rates in banks, post offices and other low risk investments, is around 6 %, and the upper limit is 8 % to 9 %, low risk investments offer an excellent opportunity to accumulate wealth in a safe manner.

But what are you told?

You are clearly told that investing in post office, banks and traditional life insurance is foolish. You are told that if you want to earn a lot of money in life,

you must be prepared to take investment risks. The financial wisdom you have learnt is to keep your money safe.

- Is your common-sense right or is the media blitzkrieg right?

- Are you doing the right thing by investing in nationalised bank fixed deposits?

- Is purchasing a traditional life insurance endowment plan okay?

The media blitzkrieg produces doubts in your mind. The media blitzkrieg tells you that you are not doing the right thing. You are told that inflation will eat into your savings, you will not achieve your financial goals. You are therefore driven to high-risk investments, where you find yourself lacking in knowledge, expertise and have no command of your investment function. Not that the financial or investment ‘experts’ have any of that.

The blitzkrieg not only produces a doubt in your mind, it also makes you feel financially illiterate. In fact, many articles in daily newspapers tell you clearly in so many words – that you are financially illiterate. And this is the precise outcome the authors of the blitzkrieg seek to achieve. Whether it is through articles in newspapers and magazines, whether it is through television talk shows, whether it is experts answering your questions in the print media or the television, (or the blogs and social media), whether it is advertising campaigns such as Mutual Fund Sahi Hai; all are designed to make you feel deficient in the knowledge necessary to invest in high-risk investments. The blitzkrieg is also designed to make you feel guilty that you are not ‘modern-minded’ enough, when you choose to not invest in shares, mutual funds, commodities, futures, etc.

Soon, this hype conditions your mind to believe that investing in low-risk investments is an outdated concept, belonging to your grandfather’s era. You

are conditioned to think that in the modern era, to which you belong, high-risk investments are the way forward. Shares, mutual funds, company debentures, futures and options (and now crypto currencies) are the path to take to earn a lot of money in a short period.

You are led to believe that you can build your house soon, have enough money for retirement, and also buy yourself the best cars and other material benefits that money can buy. Investing in banks and post office, you are convinced by the blitzkrieg, just cannot get you these wonderful things.

You have been conditioned to think of safe investment instruments as low return, not low risk. This is one of the many half-truths told to you but projected as the whole truth.

By lowering your self-esteem and making you feel guilty, the blitzkrieg is also designed to make you want ‘expert’ opinion. You are now mentally conditioned to go to ‘experts’ because you are now convinced that you do not know the subject of investments.

The hype in the media pushes you to curiosity, leading to enquiries with the ‘expert’. Almost all newspapers and magazines that deal with investments,

have an ‘expert’ column. You feel the need to approach the ‘expert’.

It is your money

It is your money. But the ‘experts’ decide where to invest. You are carrying the investment risk. The ‘experts’ share no part of this risk. If money is lost on the investment, the lost money is yours, not the ‘expert’s’. If money is gained on the investment, along with you the ‘expert’ shares the gain! This is one of the most ridiculous contractual arrangements to make.

Hiding behind the statement, your investments are subject to market risks, the ‘experts’ wash their hands off in the event of a loss.

You have to decide. Do you want to come out of the Ignis Fatuus Circle? Or do you want to be at the mercy of the ‘experts’ who draw the Circle of Ignis Fatuus around you? Are you going to take charge of your investments? Or are you going to fall prey to the machinations of the ‘experts’? Are you going to determine your investment agenda? Or are you going to accept the opinion of the ‘expert’? And when you lose money, are you going to accept the ‘expert’ post-factum reasons for why the investment has gone wrong? Or are you going to hold your ‘expert’s’ opinion accountable before the investment decision is taken?

The choice is yours. The choice you make can determine the extent of future wealth you will create out of your current income and existing wealth. You must decide that you are accountable for your investment decisions. Your advisor is just that – an advisor. Not the decision-maker.

Do not outsource your investment activity. It is very risky.

In the next few chapters, you will understand the practices in the financial sector that led to the creation of the Ignis Fatuus.

You can Send an email to the author

Almost all investors who have taken professional advice to invest their hard-earned money have, at one time or another, faced fraud, deception and mis-selling from those selling mutual funds, ULIPs and shares. Some these investors have lost all their wealth and many have committed suicide since they could not withstand the financial loss.